What’s Lurking in the Dark? Why Every Business Needs a Dark Web Exposure Report

And every person for that matter

By Darren Mott, The CyBUr Guy

First off, my apologies for being dormant on this platform for so long.. I’ll post a longer explanation at another time, but for now let’s talk data exposure and why you, as a business owner and individual, need to be aware of how vast it may be.

First, a simple question:

Do you know where your company’s data is right now?

You might assume it’s tucked safely behind your firewalls, locked down in your cloud accounts, or siloed off in databases. But what if pieces of it—employee credentials, client files, financial records—were already floating around the dark web? (And you can assume some likely is…)

If that makes you uneasy, it should.

I’ve been watching, tracking, and

studying cybercriminals since before most people knew what a botnet was. And in that time, there’s one thing I’ve learned with absolute certainty: cybercrime doesn’t sleep. And cyber bad guys (CBAs) definitely don’t wait for you to notice.

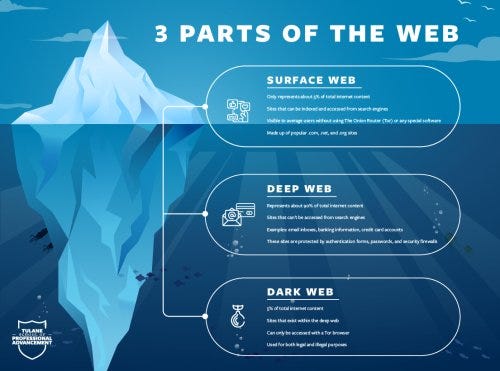

The Dark Web: Where Your Data Might Be on Sale

The dark web isn’t some Hollywood myth. It’s real. It’s active. And it’s fueling the largest transfer of economic wealth in history.

Think I’m exaggerating? According to Cybersecurity Ventures, cybercrime will cost the global economy $10.5 trillion annually by 2025. That’s “with a T.” I’m not sure where they get that number, but let’s go with it.

Here’s how it usually works:

A phishing email tricks an employee.

A credential gets reused from a prior breach.

A misconfigured cloud storage bucket is left exposed.

And boom—your data is scooped up, packaged, and listed for sale on dark web forums for a fraction of its value.

What are Cyber Bad Actors doing with your data?

Personally Identifiable Information (PII) is the crown jewel of cybercrime—and the dark web is its marketplace. When your employees' or clients' names, Social Security numbers, dates of birth, driver’s license details, or health records end up in the wrong hands, it opens the door to identity theft, tax fraud, financial account takeover, and even targeted phishing attacks.

What makes it worse is that most businesses don’t even realize this data is out there—until the damage is done. On the dark web, full identity kits (known as “fullz”) are bought and sold in bulk for pennies on the dollar, often packaged with enough information to bypass traditional security controls.

If your business stores or transmits PII—and most do—you owe it to your clients, your reputation, and your future to know whether that information has already been compromised.

It is also valuable to find out personally if your own information is floating around the Dark Web.

So What Can You Do About It?

Simple: you investigate.

My Dark Web Exposure Report service is like running a search warrant in the shadows of the internet. It’s a non-invasive scan that looks for your personal or business’s credentials, domain mentions, stolen documents, and other critical data on dark web marketplaces, breach dumps, and underground forums.

Think of it as a threat diagnostic. Before your clients’ data shows up in the wrong hands, I’ll show you exactly where you’re exposed—and ideally, how to fix it.

What’s in the Report?

Here’s what we deliver in a Gold Shield Cyber Exposure Report:

✅ Credential searches linked to your business or personal email domains

✅ Dark web forum monitoring for brand mentions and company assets

✅ Breach database hits with details on what was taken

✅ Exposure timelines, severity ratings, and remediation guidance

✅ A plain-language executive summary backed by technical details

I am leveraging advanced OSINT tools—including a partnership with Social Links—to conduct these investigations using the same data sources used by law enforcement and intelligence professionals. (Believe me, I know. I was one of them.)

Who Needs This Report?

If your business handles client data, financial information, or anything covered by confidentiality agreements, you’re a target. Period.

Law firms: Your email threads, case documents, and client PII are gold to attackers.

Insurance agencies: Claims data, policyholder records, and underwriting intel get sold fast.

Accounting firms: Tax IDs, W-2s, SSNs—all high-value assets on dark web markets.

Casinos: Loyalty users data, client and customer data, employee info.

Car Dealers: Loan information, customer and employee data.

Individuals: Find out which of your passwords have been compromised and how much of your Personally Identifiable Information is being traded.

And if your organization has undergone a recent merger, downsizing, or staff turnover? All the more reason to check. Insiders are a huge risk to your data confidentiality.

Don’t Wait for a Breach Notice to Take Action

I’ve said this before, and I’ll say it again: you can’t protect what you don’t know is exposed.

And if you’re relying solely on your firewall or antivirus to spot dark web activity, you're not seeing the whole picture.

With a Dark Web Exposure Report, you can shine a light into the shadows, giving you a snapshot of your risk posture, and help you build a plan to get ahead of the threat.

No scare tactics. Just facts. Just intelligence.

Let’s Get to Work

If you’re ready to see what’s out there—and what attackers might already know about your business—let’s talk.

👉 Schedule a confidential consultation

or email me darren@goldshieldcyber.com

Because in this fight, knowledge really is protection.

Stay CyBUr Smart,

Darren Mott

Founder, Gold Shield Cyber

Retired FBI | Cyber Threat Consultant | Cyber Private Investigator